Over the last few years, there’s been a lot of talk about Value Pricing for Client Accounting Services firms. And there are a lot of resources out there to help firms implement that model – like Intuit’s Firm of the Future website. Since I implemented value pricing in my firm five years ago, I’ve learned some important things about making sure that it’s profitable. I’d like to share a few of them with you here.

Be specific about your services

One of the most important things I’ve learned is to be very specific in agreements with clients. An agreement that lists “Monthly Bookkeeping: monthly reconciliations, recording financial transactions, paying bills, quarterly close, and financial review” is inviting disaster – especially if you’ve fixed your price for those services. Make sure you specify how, how many, how often, and who.

One of the most important things I’ve learned is to be very specific in agreements with clients. An agreement that lists “Monthly Bookkeeping: monthly reconciliations, recording financial transactions, paying bills, quarterly close, and financial review” is inviting disaster – especially if you’ve fixed your price for those services. Make sure you specify how, how many, how often, and who.

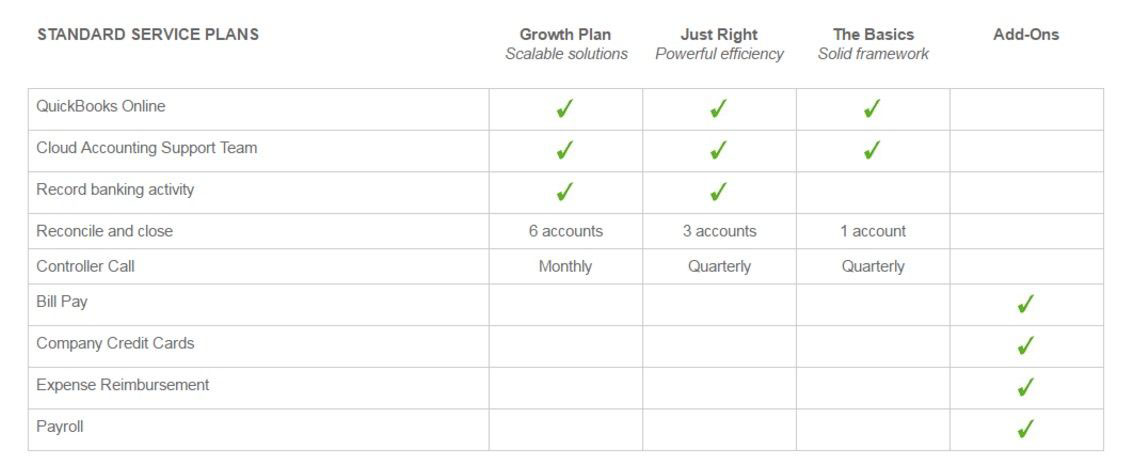

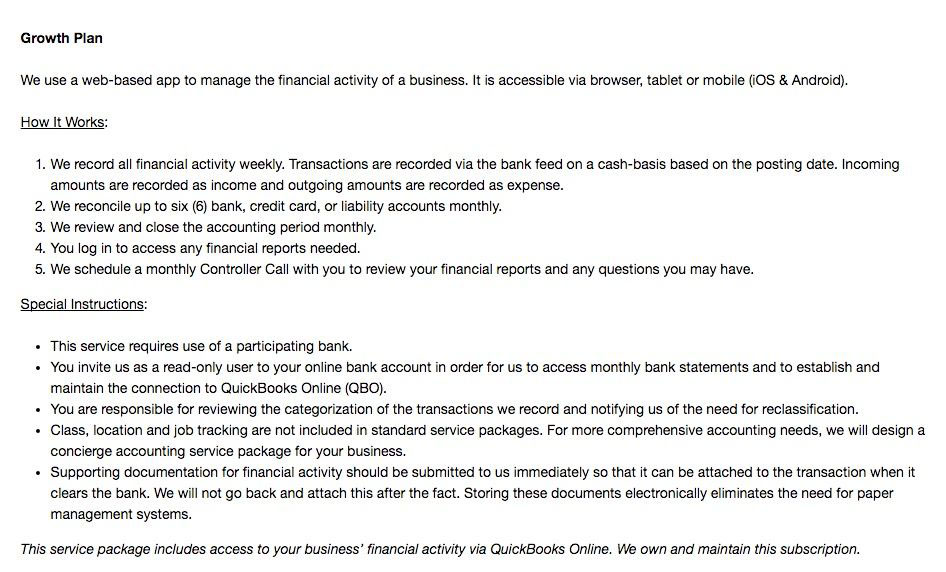

For example, we offer clients three different ‘plans’ plus a choice of add-ons. We carefully spell out the details of each plan – how often we will do what, who is responsible for what, how many transactions and accounts are included. We are also very clear that we will be using cloud accounting apps. I’ve included a screenshot of our “Growth Plan” below to give you an idea of how detailed we get.

Each plan and add-on has an equally detailed description – we try to make sure everyone knows exactly what services are being agreed upon. Otherwise, we might end up doing work that we didn’t factor into our pricing – when the clients insists that they “thought it was part of the deal.”

Pick Your Clients

You’ll notice that our clients must meet some requirements such as “participating banks” and using QBO. Redmond Accounting is paperless and operates 100% in the cloud – and we’ve made that very clear on our website. A client who can’t or won’t meet our requirements is quickly identified and referred elsewhere before we spend too much time with them. So, when you’re getting ready to implement value pricing in your firm, make sure you know who your desired customers are – and are clear about it on your website.

You’ll notice that our clients must meet some requirements such as “participating banks” and using QBO. Redmond Accounting is paperless and operates 100% in the cloud – and we’ve made that very clear on our website. A client who can’t or won’t meet our requirements is quickly identified and referred elsewhere before we spend too much time with them. So, when you’re getting ready to implement value pricing in your firm, make sure you know who your desired customers are – and are clear about it on your website.

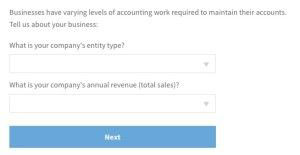

You might also have noticed that we don’t have prices on the plan grid. We’re not being coy, we just need to price differently based on a client’s size and tax entity. A prospective client can easily see pricing by answering a couple a questions. I think it’s a great idea to have this price information easily available as it helps clients ‘self-qualify’!

We have a targeted client set that allows us to operate at maximum efficiency – and profitability. Make sure you know what your target is, aim for it, and stick to it!

Define Your Services

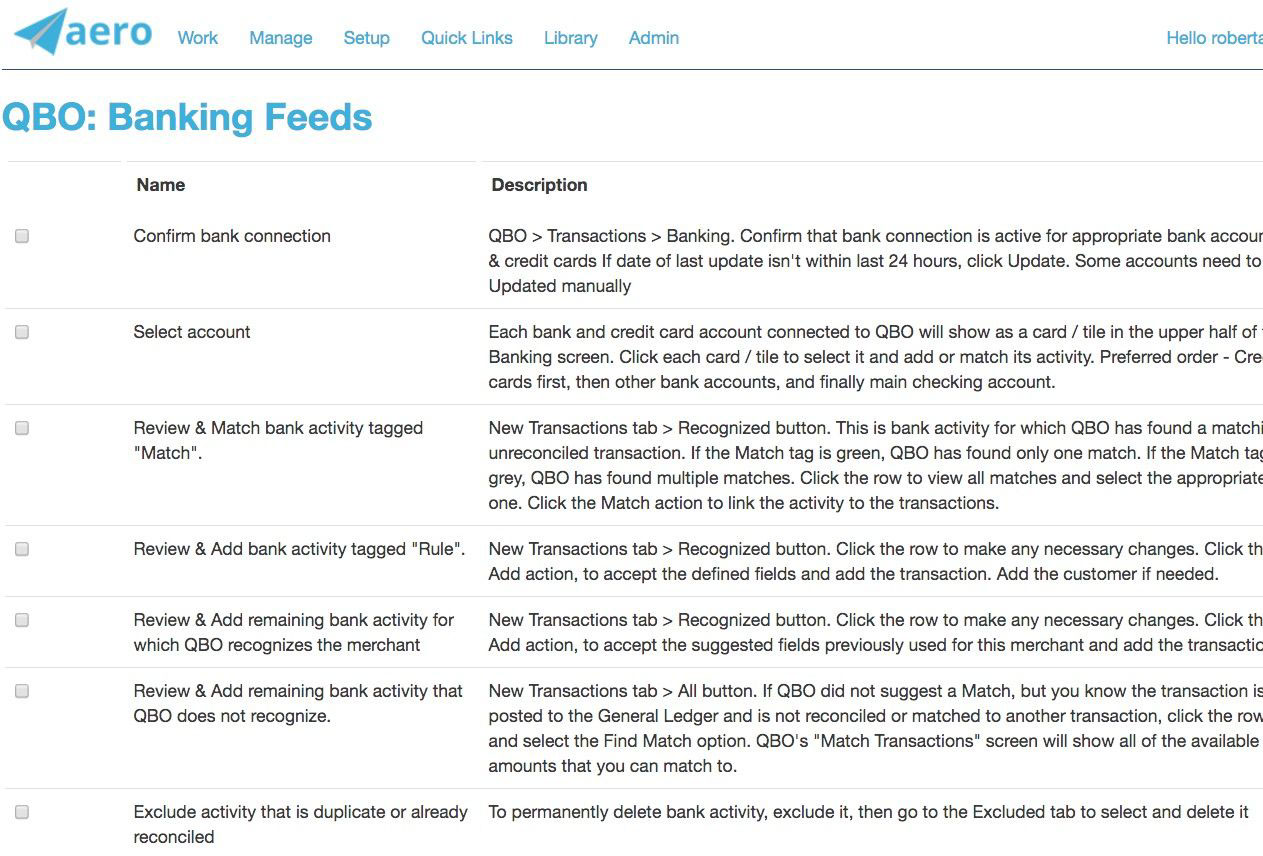

If you are going to fix your prices, then you must control your costs – and a key way to do that is to standardize your services. And to do that, you need a great workflow system like Aero. You must have a system where all of your services are spelled out so that your staff knows exactly what to do and when – and have access to all the resources they need to do it. All of our Redmond Accounting services, from reconciling an account to a controller call, are spelled out in procedures and checklists in our Aero account. When we onboard a new client, I simply grab the necessary templates, assign them to my staff, schedule them, and we’re set. I know that my staff is going to be doing exactly the work agreed upon in the new engagement because it’s all spelled out for them.

If you are going to fix your prices, then you must control your costs – and a key way to do that is to standardize your services. And to do that, you need a great workflow system like Aero. You must have a system where all of your services are spelled out so that your staff knows exactly what to do and when – and have access to all the resources they need to do it. All of our Redmond Accounting services, from reconciling an account to a controller call, are spelled out in procedures and checklists in our Aero account. When we onboard a new client, I simply grab the necessary templates, assign them to my staff, schedule them, and we’re set. I know that my staff is going to be doing exactly the work agreed upon in the new engagement because it’s all spelled out for them.

I could go on (and on) about the need to define your services and the benefits of a good workflow system like Aero, but I won’t here. If you’re interested in learning more, Aero has some great webinars on the subject.

Pieces of the Puzzle

Obviously there are a lot of things to consider when implementing value pricing in your firm. I’ve shared a few of the things I’ve learned along the way about making sure it’s profitable – I’d love to have you add your tips in the comment section below!